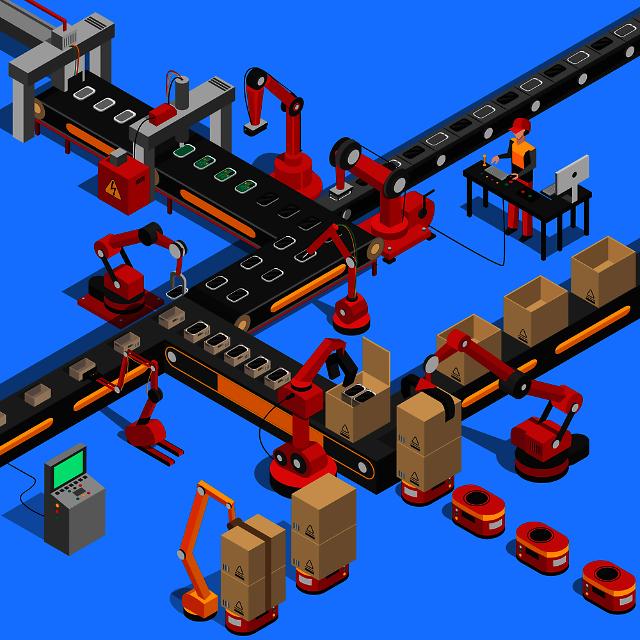

[Courtesy of Coupang]

With the help of rising popularity among young housewives and mothers, an ultra-fast "rocket" delivery service launched by South Korea's e-commerce operator, Coupang, has been successful with sales multiplying last year, but its operating loss widened due to a price war and a huge investment in logistics.

Coupang opened its service as a small deal-of-the-day start-up in 2010 but its business grew dramatically after its trademark "Rocket Delivery" based on its own logistics system and couriers was launched in early 2014. Shipping within 24 hours by its deliverymen is free for selected items.

Last year it surprised market watchers by attracting a one billion US dollar investment from Japanese telecom giant SoftBank to expand its logistics capacity. In 2014, it secured $400 million from US investors.

In a regulatory filing on Thursday, Coupang said sales jumped to 1.13 trillion won ($987 million) in 2015 from 348.5 billion won a year ago, but operating loss widened to 520 billion won due to big investments in logistics.

Coupang has promised to invest 1.5 trillion won in expanding logistics by 2017 to step up its same-day delivery service. It plans to hire 4,000 more workers in addition to 3,500 full-time delivery staff.

Last year, online malls overtook big box stores and department stores in terms of transactions, helped by active marketing and surging growth of mobile shopping and social commerce sites at the risking of increasing losses. WeMakePrice, the second largest e-commerce operator, saw sales jumping 72 percent on-year to 216 billion won in 1015 with its operating loss soaring to 144.5 billion won.

This year Coupang led a price war with low prices on daily use products such as diapers, baby formula, tissues and bottled water, prompting other online retailers and even discount supermarket chains to slash prices on select items.

As a result of aggressive marketing along with its quick and cheap service, Coupang's market share in the local online market has increased to 5.6 percent in 2015.

But CEO Kim Beom-seok promised to step up his aggressive strategy of growing through competition. His strategy was built during his days at the Harvard Business School, where he grew fascinated with Groupon and flash sales sites like Gilt Groupe, and was convinced he could transplant the idea to South Korea.

"We will make a consistent investment," he said in a statement, referring to high case reserves and investors' confidence. Despite the company's widening deficit, he remained confident about the future of his company and plans to increase its logistics centers from 17 to 21 by the end of next year.

KTB Investment and Securities said in a research paper that Coupang's cash reserve may be depleted after 2017 unless it improves its current financial structure to make a profit. There also have been cautious market analyses, pointing to the inefficient business structure of social commerce sites relying mainly on expansion through borrowed money and commission fees.

However, Kim's aggressive management has provided a good example to start-ups and some established shopping malls.

"We should catch up with Coupang, accepting the risk of financial loss," Chung Yong-jin, vice chairman of the Shinsegae Group, said in a newspaper report. "Why are we just sitting on our hands and leisurely watching the exodus?."

Chung criticized Shinsegae executives for responding in a lukewarm attitude to Coupang's aggressive strategy, as the base of the group's discount retail chain, E-mart, has been undermined by Coupang and other social commerce operators.

In February, the group joined a price war, offering to sell baby formula, feminine hygiene products, and instant coffee at the lowest possible prices.

Aju News Lim Chang-won = cwlim34@ajunews.com