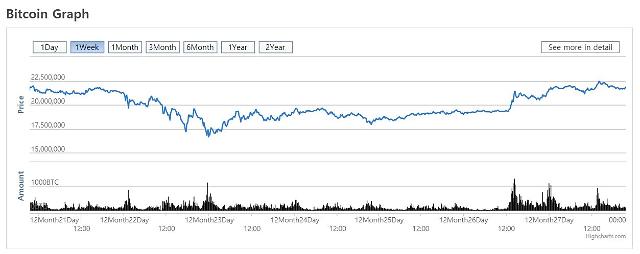

[Courtesy of Bithumb]

SEOUL, Jan. 11 (Aju News) -- Prices of popular cryptocurrencies fell sharply Thursday at South Korean exchanges as the government warned of a legal ban on trading following a crackdown by regulators, tax officials and police.

Justice Minister Park Sang-ki told reporters that the government aims to close exchanges. "There are great concerns about virtual money. The justice ministry is basically preparing a bill to ban virtual currency trading through exchanges."

The justice ministry has secured consent from other government agencies on the proposed shutdown of exchanges, he said, suggesting special legislation would come because the government regards cryptocurrency transactions as "very dangerous".

"It is a basic government position to warn that virtual currency trading is extremely dangerous and that the bubble can burst at any time," Park said, expressing concern about capital flight and big individual losses when the bubble is off.

Cryptocurrency trading has been done abnormally like "speculation and gambling", he said, accusing the digital currency market of absorbing money for industrial use.

Regulators, tax officials and police have stepped up a crackdown on illegal activities at cryptocurrency exchanges as part of efforts to curb a frenzy of rampant speculative investments. Market sentiment has already been affected by a decision by CoinMarketCap, a global cryptocurrency data provider, to exclude prices from major exchanges in South Korea.

Tax authorities launched a probe into Bithumb on Wednesday. Cryptocurrencies are not taxable because South Korea does not recognize them as financial products, but the probe into Bithumb sparked speculation that exchanges and investors could become liable for taxation.

Coinone, an exchange based in Seoul, is under investigation by a police cyber team for allowing gambling among investors. Another exchange, Coinrail, took a rare voluntary action to kick out five investors for price manipulation.

South Korea has become a hotbed for speculative investments since the craze for Bitcoin hit South Korea's online community early last year. Regulators have vowed to impose strong regulations on domestic digital money transactions and ban anonymous virtual bank accounts.

"South Korea should no longer be allowed to become a market leader in such abnormal trading," financial Services Commission (FSC) chairman Choi Jong-ku said earlier, referring to the so-called “Kimchi" premium, a large gap between domestic and international prices.

Choi threatened to close virtual accounts provided by major banks if they are found to have violated rules related to money laundering.

![[INTERVIEW] Bithumb ready for fresh leap in cryptocurrency exchange to win back customers](https://image.ajunews.com/content/image/2022/02/25/20220225152317530392.jpg)